Tips on Taking Care of Patients Whose Prescriptions Haven't Gone Generic

Posted by Emily Thompson on Sep 1st 2020

Recently we came across a fascinating Wired article in which a man suffering from Tourette’s syndrome chronicles his bi-annual pilgrimage to the UK. The primary reason for the trek is not to catch up with loved ones (though this does provide an added bonus), but something far more sinister.

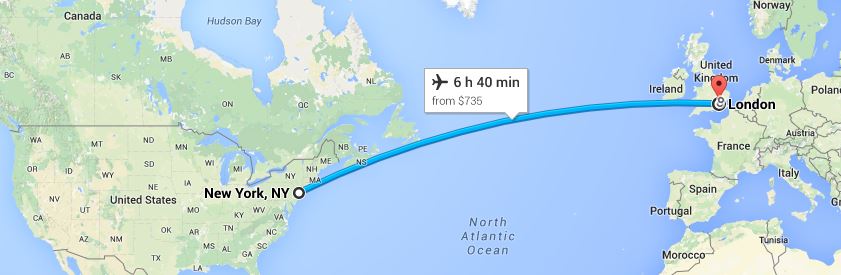

The young man travels more than 7,000 miles round trip for a three day visit for the express purpose of purchasing his medication.

It got us thinking, and reeling-- under what circumstances could two round trip tickets to Europe be cheaper than a prescription?!

In the piece, he explains that back home, where the country has socialized healthcare for its citizens, for the price of a coffee and pastry (about $12), he can pick up a six-month supply of medicine to keep him from Tourette’s nasty side effects such as marked stuttering, stumbling and trembling. Meanwhile, stateside, where he works as a writer, the same script will cost him upwards of $720 per month! And yes, that’s with insurance.

The crux of the issue boils down to one unfortunate, albeit not uncommon, scenario. There is currently no generic version of his medicine available in America.

Then we thought some more-- while we in the pharmacy sector can’t control what insurance will or won’t cover, what can we do to help our patients looking for more affordable alternatives to their non-generic daily doses?

Compounding Specialist & Consultant and former pharmacist Joey Jiminez offered the following suggestions:

- Check to see if the drug manufacturer will offer a discount card/coupon on their website for their products. You may also have to call them or fill out a form to see if you qualify for assistance through their program.

- Investigate if the brand name has a combination of drugs that could be available as a generic but in separate tablets. A quick call to the physician can allow for the switch to the generic drugs in this case.

- Always check with the insurance company as well. They may offer discounted copays for purchasing a 90-Day Supply however, you will likely have to go mail-order or through a pharmacy they delegate to process the 90-Day Supply for you.

- If your customer is paying cash, Costco generally has the cheapest cash prices (usually cost or cost plus a dispensing fee) but always encourage them to shop around. Mom and Pop stores usually have more leeway with pricing and should always be given a chance to meet or beat the price.

Ultimately, a trip across the pond may still be this bloke’s most affordable option, at least for the time being; however, by educating ourselves we stand a better chance and uncovering possible discounts and cost saving measures for our own customers.

Let’s be social! Are you following us on Facebook, Twitter and LinkedIn? We’ve got tips for how to navigate changes in the industry and killer deals on pharmacy supplies. Check us out!